FIRPTA

What is FIRPTA?

The Foreign Investment in Real Property Tax Act, also known as FIRPTA, is a United States tax law that imposes income tax on foreign persons disposing of US real property interests. All people, whether foreign or US citizens, that make money from selling property in The United States are required by law to pay taxes on their earnings every year. Domestic citizens pay this money to the IRS when they file their yearly taxes. However, the IRS had no way to tax foreign persons on the capital gains they received from the sale of US property interests unless they filed a tax return. Because non-US citizens were not filing tax returns and not paying taxes on their property sales, Congress enacted this withholding system, called FIRPTA, that places the duty on the buyer to collect the tax by withholding funds from the sale.[1] Under FIRPTA, unless an exemption or a reduced rate applies, the buyer is required to withhold 15% of the gross sales price of the property they purchased, which is used as a "deposit" and is due to the IRS within 20 days of the closing date, when purchasing from a foreign seller.

FIRPTA applies to all foreign persons, foreign corporations, and foreign partnerships, selling or transferring property located within the United States. A “foreign person” is defined under FIRPTA as: a nonresident alien individual, a foreign corporation, a foreign partnership, a foreign trust, or a foreign estate.[2] The foreign entity who is selling or transferring property is considered "the transferor", and the buyer is considered "the transferee". The transferee is responsible for determining whether or not they are buying from a foreign seller. If they are in fact buying property from a foreign seller and they fail to withhold the correct amount of money from the sale, they will be held liable by the IRS for the amount owed. There are ways to determine if FIRPTA compliance is required for your transaction and exemptions to it as well, which we'll talk more about in the next sections.

FIRPTA Compliance Requirements

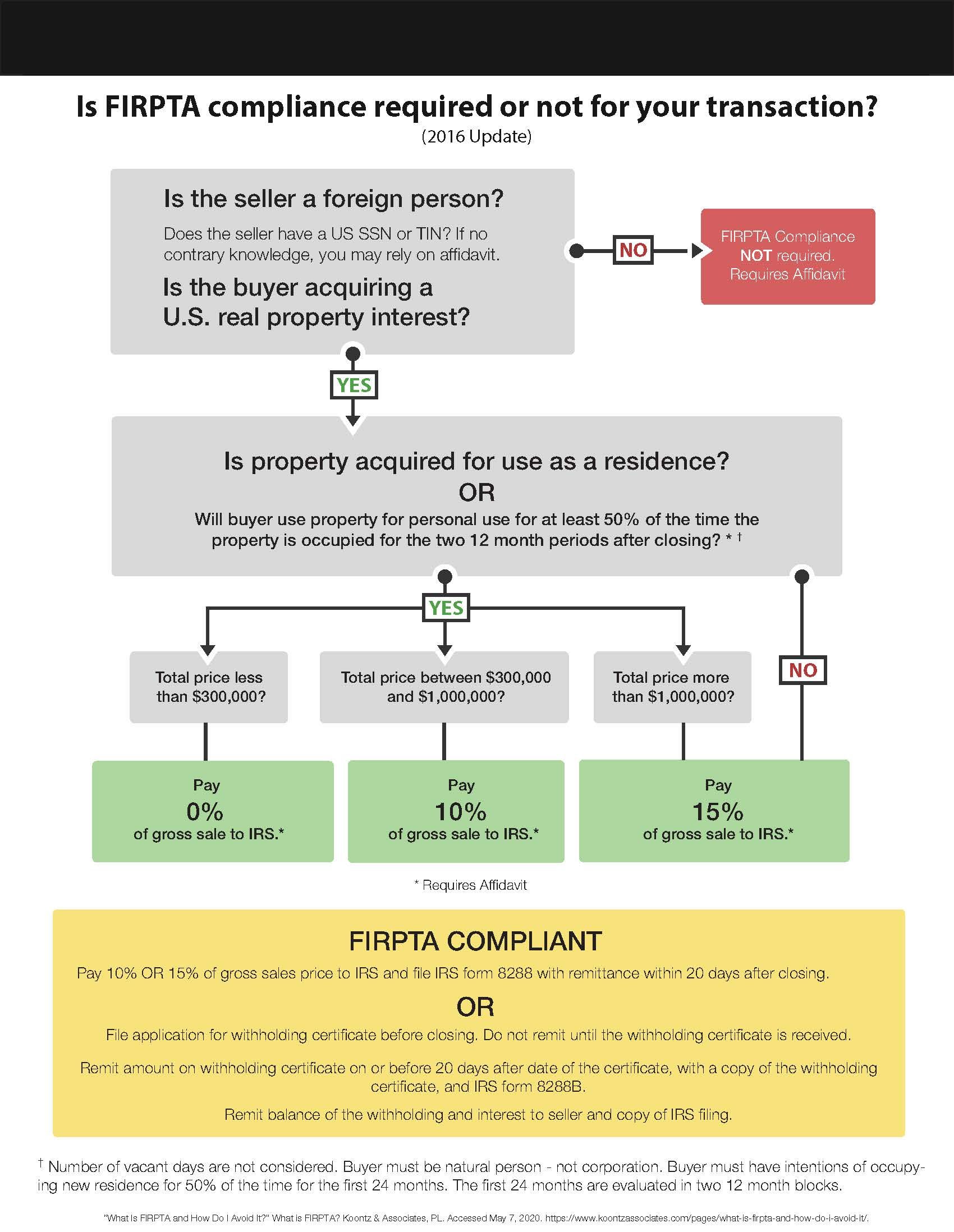

Here is a good chart to look at if you are unsure about whether or not FIRPTA is required for a transaction[3]:

The most important question to ask when purchasing U.S. real property interests is if the seller is a foreign person. If they are not foreign and are a U.S. citizen, FIRPTA withholding does not apply to the transaction. If the seller is foreign but is a resident alien with a green card, FIRPTA withholding still does not apply to the transaction. If the seller is foreign but you don’t know for sure if FIRPTA withholding applies to the transaction, see if they have either a Social Security Number (SSN) or a Taxpayer Identification Number (TIN). If the seller is foreign, it is highly unlikely that they have a Social Security Number, but they might have a Taxpayer Identification Number. Foreign citizens doing business and earning income in The United States are required to have Taxpayer Identification Numbers (TINS), which look similar to Social Security Numbers (SSNS). The test of whether FIRPTA withholding is required or not if the seller is foreign but has a TIN, is a statement made by the seller under penalty of perjury that they are not a non-resident alien for purposes of U.S. income taxation.[4] If the seller is foreign and does not have a SSN or a TIN, FIRPTA withholding may be required depending on the total price of the property as well as what the property is being purchased for.

If you have come to the conclusion that the seller is a foreign person, you then need to ask if you (the buyer), are acquiring a U.S. real property interest. A U.S. real property interest is an interest, other than as a creditor, in real property (including an interest in a mine, well, or other natural deposit) located in the United States or the U.S. Virgin Islands, as well as certain personal property that is associated with the use of real property. It also means any interest, other than as a creditor, in any domestic corporation unless it is established that the corporation was at no time a U.S. real property holding corporation during the shorter of the period during which the interest was held, or the 5-year period ending on the date of disposition.[5]

If you have determined that the seller in your transaction is a foreign person, and you have concluded that you (the buyer) are acquiring U.S. real property interests, the next thing to figure out when determining FIRPTA withholding requirements is what the property is being purchased for. If it is not being purchased for use as a personal residence, the buyer is automatically required to withhold 15% of the gross sales price for the IRS, regardless of the price of the property. If the property is being purchased for use as a personal residence, it has to meet certain requirements in order to qualify as such. The buyer or a member of the buyers family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer. When counting the number of days that the property is used, do not count the days the property will be vacant. For this exception, the transferee must be an individual, not a corporation.[6] If the property is being used as a personal residence and it meets those requirements, you should next look at the final price of the property to know how much to withhold. If the price of the property is between $300,000 and $1,000,000, the buyer will be required to withhold 10% of the gross sales price for the IRS. If the total price of the property is more than $1,000,000, the buyer will be required to withhold 15% of the total sales price for the IRS.[7] If the price of the property is under $300,000, and it is being purchased for use as a personal residence, it is exempt from FIRPTA and will not require any withholding.

Exemptions to FIRPTA Withholding

There are exemptions to FIRPTA withholding, which I talked about briefly in the last section. If the property in question is less than $300,000, the buyer will not have to withhold any amount of the gross sales price for the IRS. This is the most common exemption to FIRPTA withholding, but it only applies if the property is being purchased as a personal residence and it meets the requirements of a personal residence. Other exemptions include:

The seller furnishes a certification stating, under penalty of perjury, that the seller is not a foreign person and provides the seller's U.S. taxpayer identification number, usually a social security number

The transfer is of an interest in a non-publicly traded domestic corporation where the corporation provides a certification stating that the corporation is not and has not been a U.S. real property holding corporation or, as of the date of the transfer, the interests in the domestic corporation are not U.S. real property interests

Seller Obtains Withholding Certificate. In some cases, the seller has applied for and received a withholding certificate from the IRS that reduces or eliminates the withholding requirement. A buyer relying on this exception must obtain a copy of the Withholding Certificate and retain a copy in buyer’s records for five (5) years[8]

These three exemptions do not apply if the buyer has knowledge that the certification the seller provided is false, or if the Secretary of the Treasury requires a copy of the certification and the buyer fails to furnish one. Other exemptions are:

The buyer receives a qualifying statement, issued by the Secretary of the Treasury, stating that the foreign seller arranged to pay the tax or is exempt from the tax imposed

The interest transferred is a share of a class of stock regularly traded on an established securities market[9]

The transferor gives you written notice that no recognition of any gain or loss on the transfer is required because of a non-recognition provision in the Internal Revenue Code or a provision in a U.S. tax treaty. You must file a copy of the notice by the 20th day after the date of transfer with the Ogden Service Center

The transferor can give the certification to a qualified substitute. The qualified substitute gives you a statement, under penalties of perjury, that the certification is in the possession of the qualified substitute. For this purpose, a qualified substitute is (a) the person (including any attorney or title company) responsible for closing the transaction, other than the transferor's agent, and (b) the transferee's agent.

The amount the transferor realizes on the transfer of a U.S. real property interest is zero

The property is acquired by the United States, a U.S. state or possession, a political subdivision, or the District of Columbia

The grantor realizes an amount on the grant or lapse of an option to acquire a U.S. real property interest. However, you must withhold on the sale, exchange, or exercise of that option

The disposition is of an interest in a publicly traded partnership or trust. However, this exception does not apply to certain dispositions of substantial amounts of non-publicly traded interests in publicly traded partnerships or trusts.[10]

FIRPTA can definitely be confusing to someone who is new to the subject, but it’s important that you completely understand this law, or you could potentially owe the IRS a lot of money if you were supposed to withhold money from a transaction and you didn’t. It’s always best to consult a legal professional if you are ever unsure about withholding requirements for a transaction involving a foreign person, but you should have a decent understanding now of what FIRPTA is and the questions to ask yourself when dealing with a foreign seller.

- Gollwitzer, John. “The Buyer's Burden: FIRPTA Tax Withholding Requirements.” Attorneys' Title Guaranty Fund, Inc., June 23, 2014. https://www.atgf.com/underwriting/news/buyers-burden-firpta-tax-withholding-requirements

- “FIRPTA Withholding – Foreign Investment in Real Property Tax Act.” HBI Tax. HARDING BELL INTERNATIONAL, January 31, 2020. https://hbitax.com/resource/firpta-foreign-investment-in-real-property-tax-act-witholding/.

- “What Is FIRPTA and How Do I Avoid It?” What is FIRPTA? Koontz & Associates, PL. Accessed May 7, 2020. https://www.koontzassociates.com/pages/what-is-firpta-and-how-do-i-avoid-it/.

- “FIRPTA: Frequently Asked Questions - First American Title Insurance - Arizona - Resources - Foreign Transaction Resource.” First American Title. Accessed May 11, 2020. https://www.firstam.com/title/az/resources/foreign-transaction-resource/firpta-frequently-asked-questions.html.

- “FIRPTA Withholding.” Internal Revenue Service. Accessed May 12, 2020. https://www.irs.gov/individuals/international-taxpayers/firpta-withholding.

- “Exceptions from FIRPTA Withholding.” IRS, December 20, 2019. https://www.irs.gov/individuals/international-taxpayers/exceptions-from-firpta-withholding.

- “What Is FIRPTA and How Do I Avoid It?” What is FIRPTA? Koontz & Associates, PL. Accessed May 7, 2020. https://www.koontzassociates.com/pages/what-is-firpta-and-how-do-i-avoid-it/.

- Bloodworth, Jennifer. “Top 10 Questions About FIRPTA.” Vanguard Title Company, May 13, 2016. https://vgtitle.com/top-10-questions-firpta/.

- Gollwitzer, John. “The Buyer's Burden: FIRPTA Tax Withholding Requirements.” Attorneys' Title Guaranty Fund, Inc., June 23, 2014. https://www.atgf.com/underwriting/news/buyers-burden-firpta-tax-withholding-requirements.

- “Exceptions from FIRPTA Withholding.” IRS, December 20, 2019. https://www.irs.gov/individuals/internationaltaxpayers/exceptions-from-firpta-withholding.

BROWSE

ABOUT

Each NextHome office is independently owned and operated.

We are committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, notice any accessibility problems or should you require assistance in navigating our website, please contact us.

All Rights Reserved | Website Powered by Get.realtor.

All Rights Reserved | Website Powered by National Association of REALTORS®